The Educational Toy Channel Maze: Retail, Marketplaces, or Subscriptions for Maximum Growth?

News /

02/07/2026

The Educational Toy Channel Maze: Retail, Marketplaces, or Subscriptions for Maximum Growth?

For founders and executives in the educational toy space, product innovation is only half the battle. The other, equally critical half is navigating the complex landscape of sales channels. Should you pursue the prestige and scale of major retailers, harness the vast reach of online marketplaces, or build a loyal community through a subscription model? Each path offers distinct advantages in brand exposure, customer relationships, and revenue potential, but each also comes with its own set of operational challenges, cost structures, and strategic trade-offs. Choosing the right channel—or more likely, the right blend of channels—is a foundational decision that can determine your brand's profitability, scalability, and ultimate survival.This strategic guide breaks down the core economics and brand implications of the three primary channels for educational toys: traditional retail, online marketplaces, and subscription boxes. We’ll move beyond surface-level pros and cons to analyze wholesale margins, customer acquisition costs, inventory risks, and the long-term value of direct customer relationships. You'll gain a clear framework to assess which channel aligns with your brand's current stage, product line, and growth ambitions.

Before committing to a channel strategy, it’s essential to understand that each option represents a fundamentally different business model, with its own rules of engagement and metrics for success. Let's begin by unpacking the oldest and most established path: the world of brick-and-mortar and online retail.

The Retail Play: Is the Prestige and Scale Worth the Squeeze on Margins?

Landing a product on the shelves of a major retailer like Target, Walmart, or a specialty educational store is a milestone many toy brands dream of. It offers unparalleled brand validation, immediate mass-market exposure, and the powerful sensory experience of physical discovery. However, this path is a double-edged sword, characterized by significant upfront costs, compressed profitability, and a transfer of control that demands careful consideration.The retail model operates on wholesale. You sell your product to the retailer at roughly 40-50% of its suggested retail price (SRP), forfeiting a large portion of the margin. Beyond this, hidden costs like slotting fees, promotional discounts, chargebacks for unsold inventory, and the requirement for custom packaging can erode profitability further. The reward is instant scale and credibility.

Diving deeper, the relationship dynamics are crucial. Retailers hold significant power over inventory, pricing, and in-store placement. Your brand is competing for attention not just on the shelf, but in the buyer's office for a limited number of SKU slots. Success requires robust logistics to meet large, periodic purchase orders and the financial resilience to handle long payment terms (often 60-90 days). For an educational toy, retail success often hinges on a clear, instantly communicable value proposition—the "why" behind your toy must be understood in the 3 seconds a parent walks by. This channel is ideal for established brands with high-volume, standardized products and the operational backbone to support it.

Marketplace Momentum: Can You Win the Visibility Game on Amazon and Beyond?

Online marketplaces, led by Amazon, offer a democratized entry point to millions of active shoppers. They handle the complex infrastructure of checkout, payment, and often, fulfillment (via FBA). For educational toy brands, this means direct access to parents actively searching for "STEM toys for 5-year-olds" or "montessori puzzles." The barrier to entry is low, but the battle for visibility is intense and often paid for in advertising dollars.Marketplaces operate on a commission model, typically taking 15-20% of each sale, plus additional fees for fulfillment and storage. Your key challenge is winning the search results page. This requires relentless optimization of product listings with educational keywords, high-quality video content, and a stream of authentic reviews. Profitability becomes a direct function of your ability to manage Customer Acquisition Cost (CAC) through platform ads.

The deeper strategic consideration is one of brand equity versus sales velocity. While marketplaces drive volume, you have minimal control over the customer experience post-purchase and own limited customer data. You are also perpetually vulnerable to copycat listings and price erosion from competitors. For educational toys, success here depends on content that sells the experience and learning outcome, not just the product. A+ Content, demonstrating a child engaged in the educational play, is non-negotiable. This channel is excellent for demand validation, direct-to-consumer sales at healthier margins than wholesale, and as a complement to a brand's own DTC site—but it rarely builds a standalone, defensible brand.

The Subscription Box Promise: Building Recurring Revenue or a Product Development Grind?

The subscription box model for educational toys promises the holy grail: predictable, recurring revenue and an engaged community of loyal customers. By delivering curated, thematic learning experiences on a monthly or quarterly basis, brands build a direct, ongoing relationship with the family. However, this model is deceptively complex, shifting the primary challenge from sales and distribution to relentless product innovation and operational precision.Subscriptions trade high customer lifetime value (LTV) for high upfront acquisition cost and operational complexity. You must consistently design, source, and deliver novel product combinations that justify the recurring fee. Churn management is critical; the value proposition must evolve with the child's development to retain subscribers beyond the first few boxes. Margins can be healthy, but are consumed by high packaging, curation, and shipping costs.

To succeed, your brand must think like a curriculum developer, not just a toymaker. Each box should tell a story and demonstrate progress. This requires deep expertise in child development and a nimble, often costly, supply chain for small-batch, diverse items. Furthermore, the direct customer relationship is a goldmine of data, allowing for personalized experiences but also demanding excellent customer service. This model is less a sales channel and more a holistic business model in itself. It is ideally suited for brands with a strong editorial voice, a deep understanding of pedagogical sequencing, and the capacity for continuous content and product creation.

From Theory to Strategy: How to Build and Manage a Multi-Channel Roadmap?

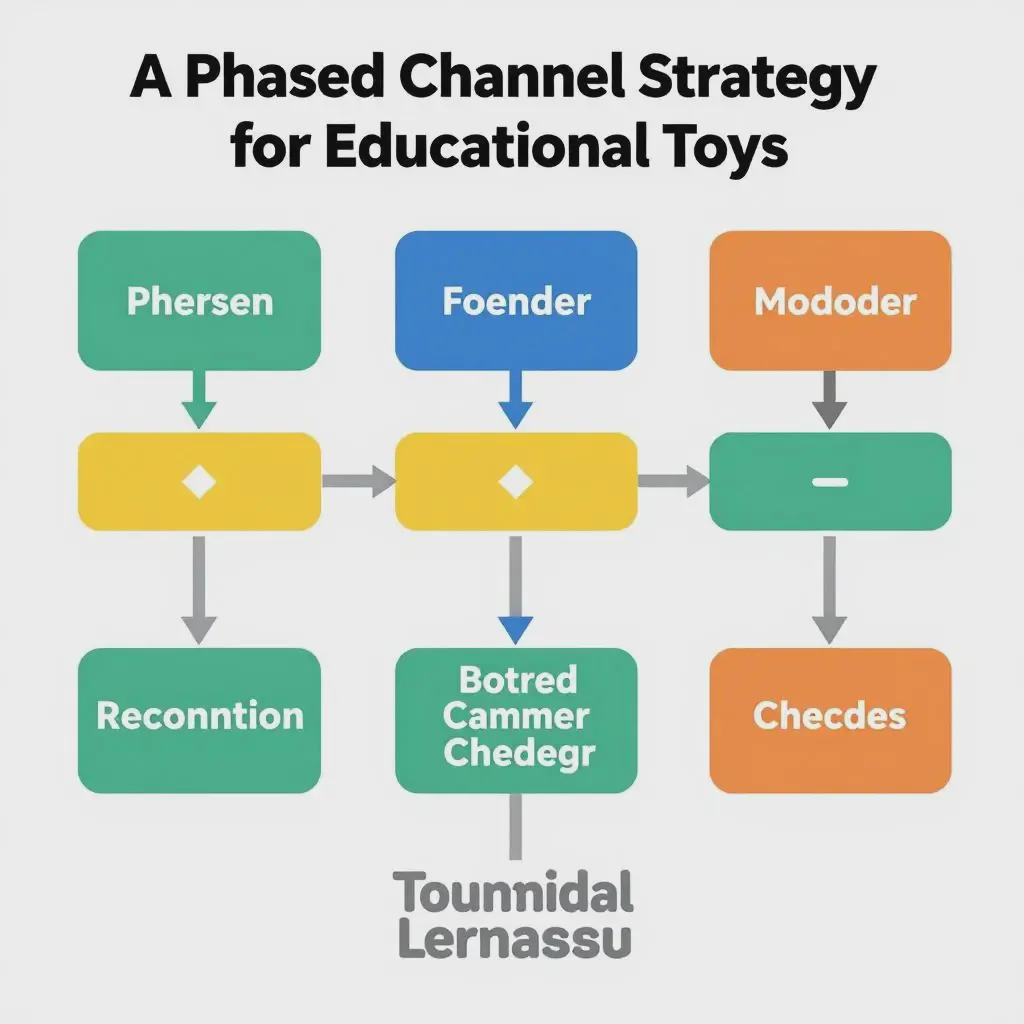

For most growing educational toy brands, the winning strategy is not an exclusive choice but a phased and integrated multi-channel approach. The goal is to let each channel fulfill a specific strategic purpose, creating a synergistic ecosystem where the whole is greater than the sum of its parts. The key is intentional sequencing and managing channel conflict.

A common roadmap starts with DTC + Marketplace for validation and margin, adds Specialty Retail for credibility and targeted reach, and later may pursue Mass Retail for scale. Use your DTC site to build brand story and community, marketplaces for demand capture and efficiency, and retail for discovery and impulse purchases. Protect brand equity with channel-specific SKUs or bundles to avoid destructive price competition.

Phase 1: Launch & Validate: DTC Website (Control, Data) + Amazon (Demand Capture).

Phase 2: Grow & Establish: Expand to Specialty Retail (Museum stores, indie shops) + wholesale to curated online boutiques.

Phase 3: Scale: Secure major national retail partnerships (with unique SKUs).*

Throughout all phases, "Subscription Box" is shown as a parallel, optional track for brands with a suitable product model.]

Effective multi-channel management requires robust systems and clear rules. Implement a Minimum Advertised Price (MAP) policy to discourage price erosion on marketplaces. Use your direct-to-consumer channel to offer exclusives, deeper educational content, or loyalty programs that can't be replicated elsewhere. Critically, your inventory forecasting becomes exponentially more complex. The data gathered from your DTC and marketplace sales—what sells, who buys it, and what they say—becomes invaluable ammunition when pitching to retailers. This strategic approach allows you to leverage the scale of retail, the efficiency of marketplaces, and the high-margin, brand-building power of DTC in a coordinated manner.

Conclusion

Selecting sales channels for your educational toy brand is not a one-time tactical decision; it is a series of strategic choices that define your business model, your customer relationships, and your growth path. There is no single "best" channel, only the best channel for your specific product, stage, and ambitions.The retail path offers scale and credibility but demands operational excellence and accepts lower margins. Marketplaces provide efficient access to vast audiences but turn branding into a constant battle for visibility in a competitive arena. The subscription model builds deep loyalty and predictable revenue but requires a transformative shift into a content and curriculum-driven operation.

The most resilient brands will view channels not as mere points of sale, but as interconnected capabilities. They will use direct channels to build the brand and gather insights, marketplaces to capture demand efficiently, and retail to amplify reach and legitimacy. By thoughtfully sequencing and integrating these channels, you can build a diversified, defensible business that educates, delights, and grows—one channel, and one child, at a time.