Retailers, Marketplaces or Subscriptions: Which Channel Mix Maximizes Educational Toy Profits?

Educational Toy Distribution Strategy: Retail, Online or Subscription Boxes?

Launching an educational toy brand involves more than creating engaging products—it requires navigating a complex distribution landscape where channel choices directly impact profitability, scalability, and brand control. As the educational toy market grows at 8% annually, reaching $34 billion globally, founders face critical decisions: pursue the prestige of retail shelves, harness the reach of online marketplaces, or build loyalty through subscription models. Each path offers different advantages in margins, customer relationships, and operational requirements. This guide provides a data-driven framework to help you select and balance distribution channels for optimal growth.

We analyze three core educational toy distribution models—traditional retail, online marketplaces, and subscription boxes—comparing their financial structures, operational demands, and strategic implications. You'll learn how to calculate true channel profitability beyond surface-level percentages, understand which model fits different business stages, and discover how to manage multiple channels without cannibalization. Whether you're launching a new STEAM toy line or expanding an established brand, this guide provides actionable insights for distribution success.

Before committing to any distribution strategy, it's crucial to understand that each channel operates as a distinct business model with its own economics, relationships, and operational demands. Let's begin by examining the most traditional and prestigious route: retail distribution.

The Retail Reality: Is 40-50% Margin Worth the Hidden Costs and Control Trade-offs?

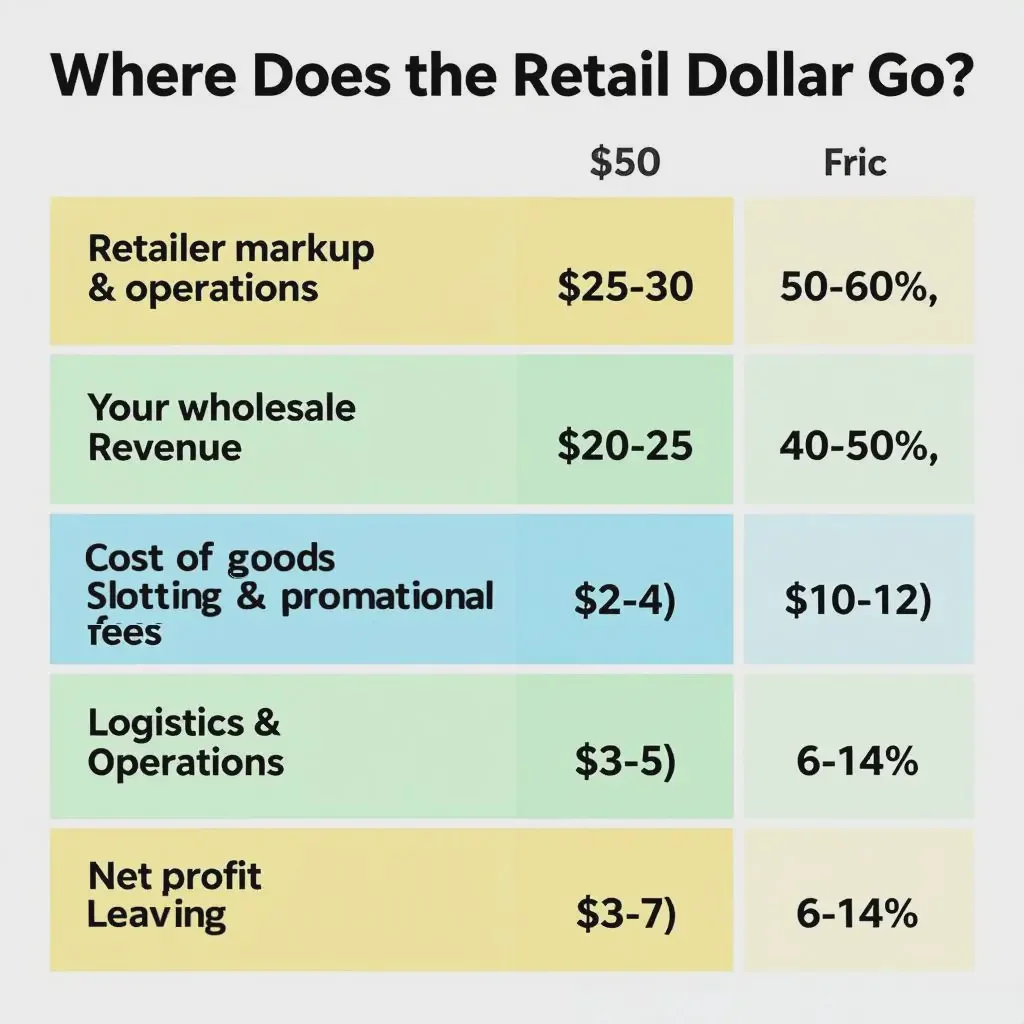

Landing shelf space at major retailers like Target, Walmart, or specialty educational stores represents a significant milestone for toy brands, offering instant credibility and mass-market exposure. However, the wholesale model that powers retail comes with substantial trade-offs that can erode profitability and limit brand control. Understanding the complete cost structure—beyond the basic 40-50% wholesale margin—is essential for making informed retail decisions.

While wholesale prices typically represent 40-50% of the suggested retail price (SRP), net margins after all retail costs often drop to 10-20%. Hidden expenses include slotting fees ($500-$5,000 per SKU), promotional allowances (5-15% of wholesale price), chargebacks for unsold inventory, and strict packaging requirements. Additionally, retailers typically demand 60-90 day payment terms, creating significant cash flow pressure.

Beyond financial considerations, retail distribution requires relinquishing significant control over brand presentation and customer relationships. Retail buyers dictate in-store positioning, promotional calendars, and often final pricing during sales events. For educational toys specifically, this can mean your carefully crafted learning narrative gets reduced to a few bullet points on packaging. Success in retail demands not just a great product, but robust operations capable of handling large, periodic orders and the financial resilience to withstand extended payment cycles. This channel works best for established brands with standardized products, strong operational infrastructure, and the ability to absorb lower margins in exchange for volume and credibility.

Marketplace Mathematics: Can You Build a Profitable Brand on Amazon's Platform?

Online marketplaces, particularly Amazon, offer educational toy brands unprecedented access to millions of actively searching parents. The platform handles complex e-commerce infrastructure while providing tools for targeted advertising and customer reviews. However, marketplace success requires mastering a different set of economics where customer acquisition costs (CAC) and competition for visibility become primary profit determinants rather than wholesale margins.

Amazon typically takes 15-20% commission plus fulfillment fees (FBA), leaving brands with 30-40% net margins on direct sales—significantly better than wholesale but requiring active marketing investment. The true challenge lies in CAC management: successful educational toy sellers spend 20-30% of revenue on Amazon Ads to maintain visibility in search results. Without this investment, even excellent products can disappear in the competitive "STEM toys" and "learning toys" categories.

Marketplaces present a fundamental tension between sales velocity and brand building. While they efficiently convert existing demand, brands surrender direct customer relationships and data ownership to the platform. Educational toy brands must therefore use marketplace listings not just as transactional pages but as educational content hubs. This means investing in A+ Content that demonstrates learning outcomes, creating comparison charts showing developmental benefits, and encouraging reviews that mention educational value specifically. Additionally, brands face constant vulnerability to copycat products and price erosion. A successful marketplace strategy often works best as part of a broader omnichannel approach, using platforms for demand capture while building true brand equity elsewhere.

Subscription Box Economics: Recurring Revenue or Constant Product Development Pressure?

The subscription box model promises the holy grail for educational toy businesses: predictable recurring revenue, direct customer relationships, and higher margins. By delivering curated learning experiences monthly or quarterly, brands build ongoing engagement with families. However, this model transforms the business fundamentally from product creation to curriculum development, with operational complexity that many underestimate during initial planning.

Subscription boxes typically operate at 50-70% gross margins but face unique cost structures: curation and assembly (10-15% of revenue), customized packaging (5-10%), and continuous content development (15-20%). The critical metric becomes customer lifetime value (LTV), which must exceed customer acquisition cost (CAC) by at least 3:1 to be sustainable. Most educational subscription boxes require 6-9 months of retention just to break even on acquisition costs, making churn management paramount.

Successful subscription boxes require thinking like educational publishers rather than traditional toy companies. Each box must deliver progressive learning value that justifies the recurring expense, necessitating expertise in child development stages and pedagogical sequencing. Operationally, brands must master small-batch procurement of diverse components and maintain flawless fulfillment timing. The subscription model also demands sophisticated CRM capabilities to personalize experiences based on child age and progress. While potentially lucrative, this path suits brands with strong editorial capabilities, flexible supply chains, and sufficient funding to sustain the long runway before achieving subscription model efficiency. Many successful educational toy companies use subscriptions as a premium offering alongside traditional sales channels rather than their sole business model.

Strategic Channel Mix: How to Balance Multiple Channels for Maximum Growth?

For most growing educational toy brands, the optimal strategy involves not choosing one channel exclusively, but developing a phased, integrated multi-channel approach. Each channel serves specific strategic purposes at different business stages, creating synergies where combined performance exceeds what any single channel could achieve alone. The key lies in intentional sequencing, clear role definition for each channel, and systems to manage inevitable channel conflicts.

A common evolution begins with direct-to-consumer (DTC) sales for maximum margin and customer data, adds marketplaces for efficient demand capture, then selectively pursues retail partnerships for credibility and scale. To prevent cannibalization, brands use channel-specific SKUs, differentiated packaging, or exclusive product variations. Advanced brands implement minimum advertised price (MAP) policies and monitor cross-channel price consistency using automated tools.

Effective multi-channel management requires treating channel strategy as a dynamic system rather than a static decision. Brands should allocate resources based on each channel's strategic role: DTC for margin and community building, marketplaces for efficient customer acquisition, retail for credibility and impulse purchases. Inventory planning becomes exponentially more complex, requiring sophisticated forecasting that accounts for different lead times and order patterns. Data integration proves crucial—customer insights from DTC should inform product development, while marketplace sales data strengthens retail buyer pitches. Perhaps most importantly, brands must maintain consistent educational messaging across all touchpoints while adapting presentation to each channel's format. This balanced approach allows educational toy companies to leverage each channel's unique strengths while mitigating individual limitations.

Conclusion

Distribution channel selection represents one of the most consequential strategic decisions for educational toy companies, directly shaping profitability, brand perception, and long-term viability. Rather than seeking a single "best" channel, successful brands develop a portfolio approach that evolves with their growth stage, product line, and market position.

Retail offers scale and credibility but demands operational excellence and accepts compressed margins. Marketplaces provide efficient access to massive audiences but turn branding into a continuous battle for visibility. Subscription models build deep loyalty and predictable revenue but require transformation into curriculum-driven content engines.

The most resilient educational toy brands view channels not as isolated sales avenues but as interconnected components of a distribution ecosystem. They use direct channels to build brand narrative and gather invaluable customer insights, marketplaces to capture demand with capital efficiency, and retail partnerships to amplify reach and legitimacy. By thoughtfully sequencing channel expansion and implementing systems to manage cross-channel complexity, founders can build businesses that withstand market fluctuations and competitive pressures.

Ultimately, the right distribution strategy aligns with your brand's educational mission while delivering sustainable economics. It allows you to focus on what matters most: creating toys that inspire learning, curiosity, and joy—regardless of where or how families discover them.