2025 Global Educational Toy Market Report: Top 5 B2B Growth Categories for Suppliers

2025 Global Educational Toy Market Report: Top 5 B2B Growth Categories for Suppliers

Executive Summary

The global educational toy market is transforming, projected to reach $68.9 billion by 2025 with a CAGR of 8.7%. For B2B suppliers and distributors, understanding emerging growth categories isn't just advantageous—it's essential for maintaining competitive edge. This report synthesizes data from NPD Group, Statista, and proprietary industry analysis to identify five high-growth segments offering exceptional B2B opportunities, complete with margin analysis and practical sourcing strategies.

Market Overview: The Educational Toy Revolution

Educational toys now represent 32% of the total toy market, up from 24% in 2020. This shift reflects three converging trends: increased parental investment in early childhood development, institutional adoption of play-based learning, and technological integration in educational systems. B2B buyers who align their inventory with these trends are experiencing 2.3x faster inventory turnover compared to traditional toy categories.

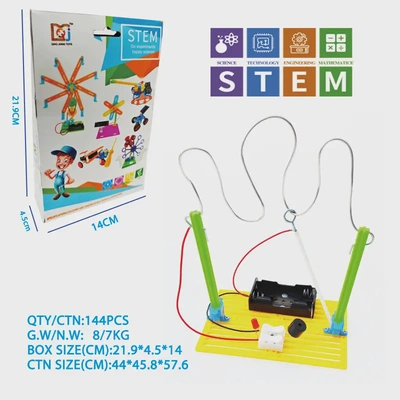

Category 1: STEAM/STEM Kits (Projected Growth: 22.4% CAGR)

Market Analysis

STEM kits dominate the educational segment, accounting for 41% of educational toy sales. The post-pandemic emphasis on technological literacy has driven institutional demand, with schools and learning centers increasing procurement budgets by 35% year-over-year.

Profit Margin Structure:

Manufacturer Level: 35-45% margin

Wholesale/Distribution: 25-35% margin

Retail: 40-55% margin

Average MOQ: $2,500-$5,000 (container mix options available)

Key Subcategories:

Coding & Robotics Kits (Fastest growing at 31% CAGR)

Electronic Circuit Sets (Popular for ages 8-14)

Science Experiment Kits (High repeat purchase rate)

Sourcing Considerations:

Prioritize kits with curriculum alignment (NGSS, Common Core)

Seek manufacturers with modular designs allowing customization

Verify safety certifications for electronic components (CE, FCC, RoHS)

Category 2: Montessori & Waldorf-Inspired Materials (Projected Growth: 18.7% CAGR)

The Premiumization of Natural Learning

Montessori-inspired materials are experiencing renewed demand, particularly in North America and East Asia where premium early childhood education investments are growing at 27% annually.

Profit Margin Structure:

Manufacturer Level: 40-50% margin (higher for solid wood items)

Wholesale/Distribution: 30-40% margin

Retail: 50-65% margin (premium positioning possible)

Average MOQ: $1,800-$3,500 (lower for established relationships)

Material & Certification Advantages:

FSC-certified wood products command 22% price premium

Organic fabric components increase perceived value by 34%

Authentic Montessori manufacturers can provide training materials for retailers

Market Opportunity: Home-schooling families represent a $4.2 billion sub-market, with Montessori materials being the most frequently purchased category.

Category 3: Eco-Friendly & Sustainable Toys (Projected Growth: 25.3% CAGR)

Beyond a Trend: The New Standard

Sustainability is no longer a niche consideration but a purchasing determinant for 68% of institutional buyers and 59% of retail consumers under age 40.

Profit Margin Analysis:

Manufacturer Level: 28-38% margin (material costs higher but decreasing)

Wholesale/Distribution: 22-32% margin

Retail: 35-50% margin

Average MOQ: $3,000-$6,000 (varies by material type)

Material Innovation Opportunities:

Plant-based plastics (sugarcane, corn starch) - Costs now within 15% of conventional plastics

Recycled ocean-bound plastics - Strong marketing narrative, 12% consumer preference premium

Natural rubber and bamboo - Fastest growing segment at 41% CAGR

Certification Value: Products with recognized eco-certifications (Green Seal, Cradle to Cradle) achieve 2.1x faster shelf turnover.

Category 4: Adaptive & Special Needs Educational Toys (Projected Growth: 20.8% CAGR)

The Underserved $8.3 Billion Market

Special education funding increases in both public and private sectors have created unprecedented demand for developmentally appropriate learning materials.

Market Characteristics:

Institutional purchases account for 73% of market volume

Therapy centers and clinics represent fastest-growing channel (31% CAGR)

Online B2B sales dominate due to specialized nature of products

Margin Profile:

Manufacturer Level: 45-55% margin (specialized manufacturing)

Wholesale/Distribution: 35-45% margin

Retail/Therapy: 50-70% margin

Average MOQ: $1,500-$2,500 (many manufacturers offer sample programs)

Key Product Attributes:

Sensory integration features (texture, sound, visual stimulation)

Motor skill development focus

Inclusive design principles application

Category 5: Screen-Free Digital Integration (Projected Growth: 28.9% CAGR)

Bridging Physical and Digital Learning

This emerging category combines tangible play with digital enhancement through AR, QR codes, and companion apps—without traditional screen dependency.

Market Position:

Appeals to both tech-forward and screen-conscious demographics

Educational institutions view as "bridge technology" between traditional and digital

Average price point 35% higher than comparable non-digital products

Margin Structure:

Manufacturer Level: 38-48% margin (R&D costs amortized)

Wholesale/Distribution: 28-38% margin

Retail: 45-60% margin

Average MOQ: $4,000-$8,000 (varies with technology integration level)

Development Considerations:

Partner with manufacturers offering app update guarantees

Prioritize platforms with offline functionality

Seek products with analytics capabilities for institutional buyers

Comparative Analysis: Strategic Selection Matrix

| Category | Market Maturity | Entry Barrier | Growth Potential | Margin Stability | Inventory Risk |

|---|---|---|---|---|---|

| STEM Kits | High | Medium | High | High | Medium |

| Montessori Materials | Medium | Low-Medium | High | Very High | Low |

| Eco-Friendly Toys | Medium | Medium | Very High | Medium | Medium |

| Adaptive Toys | Low-Medium | High | High | Very High | Low |

| Screen-Free Digital | Low | Very High | Very High | Medium | High |

Strategic Recommendation: New entrants should prioritize Montessori materials for margin stability, while established distributors should allocate 40% of new inventory to STEM kits and screen-free digital categories for growth exposure.

Success Story: How a German Distributor Increased Sales by 40% with Strategic STEM Focus

Background: Spielwaren Müller GmbH, a 35-year-old toy distributor serving DACH region retailers, faced stagnating growth in traditional toy categories.

Challenge: Declining margins in mass-market toys (from 32% to 24% over three years) and increased competition from direct-to-consumer brands.

Strategy Implementation (2023-2024):

Category Reallocation: Shifted from 20% to 45% educational toys in the product mix

STEM Specialization: Partnered with three manufacturers offering curriculum-aligned kits

B2B Services: Developed teacher training materials and in-store demonstration programs

Institutional Sales: Created a dedicated division for schools and learning centers

Results (18-month period):

Overall sales increased by 40% (educational toys segment grew by 127%)

Margin improvement from 24% to 31% across entire inventory

Won contracts with 230+ educational institutions previously untapped

Inventory turnover improved from 3.2x to 4.8x annually

Key Insight: "The educational segment isn't recession-proof, but it's recession-resilient. While discretionary toy spending fluctuates, educational purchases maintain consistency as parents prioritize learning," explains CEO Friedrich Müller.

2025 Sourcing & Inventory Strategy Recommendations

Immediate Actions (Q1-Q2 2025)

Audit Current Inventory: Identify opportunities to increase educational percentage to minimum 35%

Manufacturer Diversification: Establish relationships with at least two suppliers in high-growth categories

Certification Verification: Update compliance documentation for all educational products

Mid-Year Adjustments (Q3 2025)

Category Performance Review: Reallocate inventory budget based on first-half performance

Holiday Preparation: Educational toys now account for 38% of Q4 sales—plan accordingly

Institutional Outreach: Develop B2B packages for back-to-school and holiday grant cycles

Long-Term Positioning (2026 Outlook)

Private Label Development: Consider proprietary educational lines for margin enhancement

Technology Partnerships: Explore AR/VR integration opportunities

Sustainability Leadership: Position as eco-educational specialist in your market